We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK. If you do not, click Cancel.

Coca-Cola Earnings: Is This Rapid-Growth Rival a Better Beverage Bet?

Read MoreHide Full Article

Investors and consumers alike have long asked “Coke or Pepsi?” This is a reasonable question as both stocks and products are very comparable and both have satisfied consumers and investors for decades.

They both have vast portfolios of products delighting customers daily, steadily growing share prices and earnings, and tidy dividends regularly satisfying shareholders.

But newcomer Celsius (CELH - Free Report) , defining and taking over the “functional beverage” market may actually be the stock investors should be considering. Celsius stock has been untouchable in terms of performance, compounding at a ridiculous 121% annually over the last five years.

So should investors pick one of these stocks, or may they complement each other in a well-diversified portfolio?

Soft drink giant Coca-Cola (KO - Free Report) reports earnings Tuesday after the market closes, while PepsiCo (PEP - Free Report) doesn’t report again until late April and Celsius in March.

Image Source: Zacks Investment Research

Coca-Cola: A Legacy of Refreshment

Coca-Cola stands as a titan of the beverage industry, boasting a brand recognition that transcends borders. Its core portfolio, anchored by the classic Coke and Sprite, enjoys enduring popularity. Management has also steadily been adding products, venturing into the healthy and functional category with Coke Zero Sugar, Smart Water and Topo Chico.

Coca-Cola stock currently has a Zacks Rank #3 (Hold) rating, reflecting a flat earnings revisions trend. Sales for the current quarter are forecast to grow 5.1% YoY and for FY23 5.8% YoY. Earnings over the same periods are projected to increase 6.7% YoY and 8%YoY.

These growth rates are consistent with the long-term, steady increases management and shareholders love to see. KO also pays a dividend yield of 3.1% and has raised the payment by an average of 3.4% annually over the last five years.

Image Source: Zacks Investment Research

PepsiCo: The Rival

PepsiCo has long been the archrival to Coca-Cola and presents a formidable challenge. Pepsi too has a very strong brand and is further bolstered by its snacks brands at Frito-Lay and sports drink Gatorade.

Like KO, PEP’s earnings revision trend has been flat over the past two months, giving it a Zacks Rank #3 (Hold) rating. Growth rates for Pepsi are nearly the same as Coca-Cola, but slightly lower.

The two companies also have very similar valuations, with KO trading at a one year forward earnings multiple of 21.3x and PEP 21x. They are also both below their respective historical median valuations, with KO’s 10-year median at 23.1x and PEP’s at 22.3x.

PepsiCo too pays a handsome dividend yield of 3% and has raised the payout by an average of 6.7% annually over the last five years.

Image Source: Zacks Investment Research

The two soft drink behemoths have had very similar returns since the start of 2023 as well, losing ~6% over the last 14 months. In the chart below we can see that in October of 2023, both stocks experienced some heavy selling, pushing them down double digits YTD, while the market leaders were up considerably on the year.

It is not often you get the opportunity to pick up companies as high-quality as Coca-Cola and PepsiCo, and those investors who stepped up during the selloff have done decently well.

Image Source: TradingView

Celsius: The Maverick Newcomer

Celsius, a relative newcomer, has carved a niche in the functional beverage market with its fitness-focused drinks. Its bold flavors and focus on energy, metabolism, and endurance have attracted a loyal following.

Celsius too has a Zacks Rank #3 (Hold), reflecting a mixed earnings revision trend. But the epic returns from its stock are driven by the almost unbelievable sales growth the company has seen. In 2019, annual sales at CELH were $75 million. In the trailing 12 months they are $1.15 billion. You would be hard pressed to find a single other company that grew at such a rate.

Sales and earnings forecasts are very strong as well, which can be seen in the table below. Current year sales are expected to climb nearly 100% YoY to $1.3 billion and EPS are projected to jump 185%.

Image Source: Zacks Investment Research

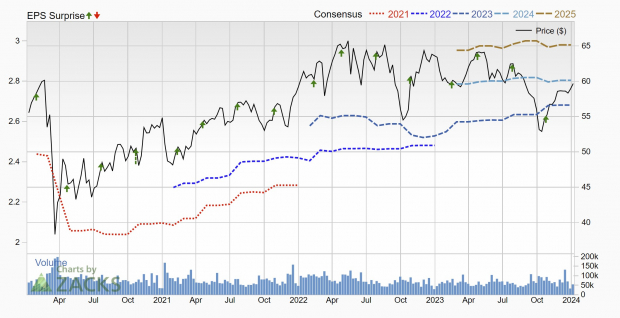

The long-term price action chart on CELH looks quite promising as well. The stock price has traded sideways for nearly six months now, building a very large and convincing bull flag. If the stock can break out above the $60 level, we could see the stock explode to new highs again.

Image Source: TradingView

Bottom Line

To be honest, at current levels I think all of these stocks are quite appealing. Even with the mixed earnings revision trends, they are each trading below their historical median valuations, and provide investors with complementary portfolio returns.

If those earnings revisions trends began to trend higher, and the Zacks Ranks improves, any one of these stocks would be a screaming buy. Otherwise, Coca-Cola and PepsiCo offer nice dividend yields at a reasonable valuation, while Celsius offers the potential for exceptional returns, though with higher volatility.

The earnings meeting this afternoon from Coca-Cola should provide some very interesting insight into the industry and sector more broadly.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report FREE:

Image: Bigstock

Coca-Cola Earnings: Is This Rapid-Growth Rival a Better Beverage Bet?

Investors and consumers alike have long asked “Coke or Pepsi?” This is a reasonable question as both stocks and products are very comparable and both have satisfied consumers and investors for decades.

They both have vast portfolios of products delighting customers daily, steadily growing share prices and earnings, and tidy dividends regularly satisfying shareholders.

But newcomer Celsius (CELH - Free Report) , defining and taking over the “functional beverage” market may actually be the stock investors should be considering. Celsius stock has been untouchable in terms of performance, compounding at a ridiculous 121% annually over the last five years.

So should investors pick one of these stocks, or may they complement each other in a well-diversified portfolio?

Soft drink giant Coca-Cola (KO - Free Report) reports earnings Tuesday after the market closes, while PepsiCo (PEP - Free Report) doesn’t report again until late April and Celsius in March.

Image Source: Zacks Investment Research

Coca-Cola: A Legacy of Refreshment

Coca-Cola stands as a titan of the beverage industry, boasting a brand recognition that transcends borders. Its core portfolio, anchored by the classic Coke and Sprite, enjoys enduring popularity. Management has also steadily been adding products, venturing into the healthy and functional category with Coke Zero Sugar, Smart Water and Topo Chico.

Coca-Cola stock currently has a Zacks Rank #3 (Hold) rating, reflecting a flat earnings revisions trend. Sales for the current quarter are forecast to grow 5.1% YoY and for FY23 5.8% YoY. Earnings over the same periods are projected to increase 6.7% YoY and 8%YoY.

These growth rates are consistent with the long-term, steady increases management and shareholders love to see. KO also pays a dividend yield of 3.1% and has raised the payment by an average of 3.4% annually over the last five years.

Image Source: Zacks Investment Research

PepsiCo: The Rival

PepsiCo has long been the archrival to Coca-Cola and presents a formidable challenge. Pepsi too has a very strong brand and is further bolstered by its snacks brands at Frito-Lay and sports drink Gatorade.

Like KO, PEP’s earnings revision trend has been flat over the past two months, giving it a Zacks Rank #3 (Hold) rating. Growth rates for Pepsi are nearly the same as Coca-Cola, but slightly lower.

The two companies also have very similar valuations, with KO trading at a one year forward earnings multiple of 21.3x and PEP 21x. They are also both below their respective historical median valuations, with KO’s 10-year median at 23.1x and PEP’s at 22.3x.

PepsiCo too pays a handsome dividend yield of 3% and has raised the payout by an average of 6.7% annually over the last five years.

Image Source: Zacks Investment Research

The two soft drink behemoths have had very similar returns since the start of 2023 as well, losing ~6% over the last 14 months. In the chart below we can see that in October of 2023, both stocks experienced some heavy selling, pushing them down double digits YTD, while the market leaders were up considerably on the year.

It is not often you get the opportunity to pick up companies as high-quality as Coca-Cola and PepsiCo, and those investors who stepped up during the selloff have done decently well.

Image Source: TradingView

Celsius: The Maverick Newcomer

Celsius, a relative newcomer, has carved a niche in the functional beverage market with its fitness-focused drinks. Its bold flavors and focus on energy, metabolism, and endurance have attracted a loyal following.

Celsius too has a Zacks Rank #3 (Hold), reflecting a mixed earnings revision trend. But the epic returns from its stock are driven by the almost unbelievable sales growth the company has seen. In 2019, annual sales at CELH were $75 million. In the trailing 12 months they are $1.15 billion. You would be hard pressed to find a single other company that grew at such a rate.

Sales and earnings forecasts are very strong as well, which can be seen in the table below. Current year sales are expected to climb nearly 100% YoY to $1.3 billion and EPS are projected to jump 185%.

Image Source: Zacks Investment Research

The long-term price action chart on CELH looks quite promising as well. The stock price has traded sideways for nearly six months now, building a very large and convincing bull flag. If the stock can break out above the $60 level, we could see the stock explode to new highs again.

Image Source: TradingView

Bottom Line

To be honest, at current levels I think all of these stocks are quite appealing. Even with the mixed earnings revision trends, they are each trading below their historical median valuations, and provide investors with complementary portfolio returns.

If those earnings revisions trends began to trend higher, and the Zacks Ranks improves, any one of these stocks would be a screaming buy. Otherwise, Coca-Cola and PepsiCo offer nice dividend yields at a reasonable valuation, while Celsius offers the potential for exceptional returns, though with higher volatility.

The earnings meeting this afternoon from Coca-Cola should provide some very interesting insight into the industry and sector more broadly.